- The average fee charged for a tax return is approximately $350. For those individuals who earn minimum wage, that can represent nearly 5 days of work. This does not include the cost for the “rapid refund” which is usually about $200. Low income filers can easily pay nearly $500. Our goal is to keep that money in the pockets of low income Niagara County residents—and keep them away from the for profit sites which prey on the financially unstable population.

- To increase their business, for profit tax companies cluster in low income neighborhoods. Current statistics show that nearly 70% of low income families use a commercial tax preparer. This is why our program—and our locations—is vital for our communities.

Author: Noelle Carter

What is Financial Counseling? What is Credit Counseling? What are Debt Management Plans? What’s the Difference?!?!?

Financial Counseling can also be called budget counseling or financial coaching. This is a service provided by many nonprofit or for-profit service providers to review a personal budget. An agency offering Financial Counseling may or may not be offering Credit Counseling and Debt Management. When a Credit Counseling organization offers a Financial Counseling session, it will always include components regarding Credit Counseling and Debt Management.

Credit Counseling and Debt Management are often synonymous when locating information. While very closely related, they are not the same activity. Let’s first review what each of those truly are:

It’s for these reasons that Credit Counseling and Debt Management are inseparably linked services. An individual cannot have a Credit Counseling session without the review of an actionable Debt Management Plan; an individual cannot have a Debt Management Plan without first engaging in Credit Counseling.

The Federal Trade Commission notes that “most reputable credit counselors are non-profit and offer services at local offices, online, or on the phone” (source, FTC website). The FTC also states that reputable counselors are trained in consumer credit, money and debt management, and budgeting; without each of these a counselor would fall short of the FTC’s definition of a reputable organization.

Housing and Urban Development (HUD) trained housing counselors are experts in housing related issues. Their training consists of 1) pre-purchase counseling to assist those in obtaining a new home, 2) post-purchase or delinquency mortgage counseling, 3) rental counseling for those that have difficulties with their landlord, 4) reverse mortgage counseling, and 5) budget only counseling to train individuals on personal budget techniques and provide ideas on how to reduce personal expenses to better balance their budget. HUD housing counselors that don’t work with an agency that provides Debt Management Plans are not trained to provide information on how a Debt Management Plan will work for anyone. It’s understandable though, how can they provide specific information on a service they do not directly engage.

The Consumer Financial Protection Bureau echoes the view of the FTC, “Credit counseling organizations can advise you on your money and debts, help you with a budget, and offer money management workshops” (source, CFPB website). Without a full spectrum review of an individual’s debts and advice of all of the options to pay them off, a counselor falls short of the CFPB’s definition of credit counseling.

New York State’s Department of Financial Services permits Debt Management activities under the “Budget Planner” license. With the services synonymously and inseparably linked, only licensed Budget Planners in New York can ethically note themselves as Credit Counselors.

The only agency in Western New York able to provide Credit Counseling is Consumer Credit Counseling Service of Buffalo, Inc. (CCCS of Buffalo). CCCS is a non-profit, full-service credit counseling agency, providing confidential financial guidance, financial education, counseling and debt management assistance to consumers since 1965. CCCS helps consumers trim expenses, develop a spending plan and repay debts. Counselors are trained and certified through the National Foundation for Credit Counseling and HUD housing counseling. CCCS of Buffalo is licensed by the NYS Department of Financial Services as a “Budget Planner”.

Counseling is available at our Main Office in West Seneca, in one of our Satellite Offices, by telephone and via Internet. Visit www.consumercreditbuffalo.orgfor more information.

If you are struggling with debt, make sure your first call is to CCCS, your Money Mentors!

Non-profit credit counseling agencies provide financial education and non-biased advice on debt repayment options. Additionally, CCCS can review a Debt Management Plan for those who it may be appropriate for – reduction in interest rates and a structured payment plan allows individuals to become debt free in 5 years or less.

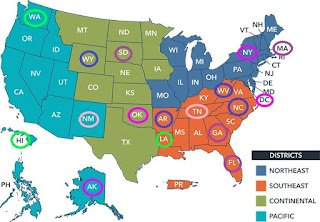

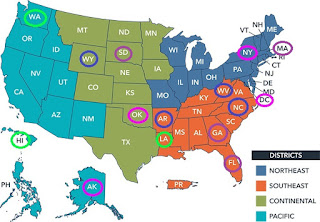

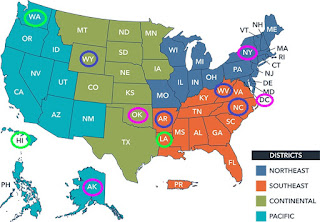

Contact CCCS to start your journey to a debt free future-now able to help those in Florida, Georgia, Massachusetts, South Dakota too! 800-926-9685

🤩Washington

🤩Hawaii

✔️New York

✔️D.C.

✔️Oklahoma

✔️West Virginia

✔️North Carolina

✔️Arkansas

✔️Wyoming

✔️Alaska