Parachute Credit Counseling provides services to help clients “dare to be debt free”

BUFFALO, NY (December 7, 2022) – Consumer Credit Counseling Service of Buffalo announced it has changed its name to Parachute Credit Counseling to illustrate the agency’s commitment toward being a guide on their client’s journey to “dare to be debt free.” Clients will still get the same quality service they have relied on for more than 50 years, but now with a new look.

“We wanted to change our name and logo to reflect our mission of making our clients feel empowered and not embarrassed about their debt,” said Parachute President & CEO Noelle Carter. “It takes courage to make that leap and we are here to be a parachute – a guide – on the journey to financial stability and becoming debt free.”

Parachute Credit Counseling mission is to be the most trusted guide on an individual’s journey to becoming debt free. With the right tools and a strategically mapped out plan, clients can make a smooth soft landing on the other side of debt.

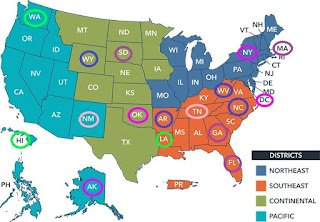

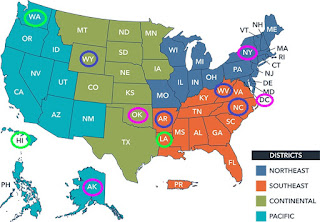

Parachute Credit Counseling is a nonprofit agency offering financial counseling, debt management, student loan counseling, financial coaching, credit report review, reverse mortgage counseling, pre-purchase homebuyer counseling, delinquency housing counseling, and small business credit counseling. The agency offers services in 18 states and the District of Columbia.

For more information about upcoming workshops and the services Parachute offers, visit the website at (insert new website here) or call 716-712-2060 to set up an appointment at any of the locations.

ABOUT PARACHUTE Parachute Credit Counseling, formerly, Consumer Credit Counseling Service of Buffalo, Inc. is a nonprofit agency established in 1965 to provide the best strategies to help people master their credit. Parachute is a member of the of the National Foundation for Credit Counseling and an A+ member of the Better Business Bureau. It is also a certified HUD counseling agency, licensed budget planner through the NYS Department of Financial Services, Executive Office of the U.S. Trustees approved for certified bankruptcy counseling sessions and accredited by Council on Accreditation of Services for Families & Children (COA), Inc. Parachute is based in Buffalo, NY, but offers services in Arkansas, Alaska, District of Columbia, Florida, Georgia, Hawaii, Illinois, Louisiana, Massachusetts, New Mexico, New York, North Carolina, Ohio, Oklahoma, South Dakota, Tennessee, West Virginia, Washington, & Wyoming.